The Beginnings of KAYA

2012

Regional payments was discussed as part of the Association of Asian Confederation of Credit Unions (ACCU) consultancy with the global software company Temenos.

2013

Payments proposal was considered at the ACCU CEOs’ workshop in Bali.

2014

Asian co-op federations sign a Memorandum of Understanding. Another CEOs’ workshop was conducted to review and model the ACCU Payment Platform.

2014

A survey by the BangkoSentralngPilipinas reveals only one-third of Filipinos relied on formal savings and credit due to 1) financial illiteracy, 2) rural folk had no access to formal financial institutions. Cooperatives, which operate in the countryside, as well as mobile payments, were seen by the BSP as an important sector to reach the ‘unbanked’ Filipinos.

May 2015

The two largest co-op federations in the Philippines, National Confederation of Cooperatives (NATCCO) and the Philippine Federation of Credit Unions (PFCCO), hold the 2nd Joint Educational Forum in Davao City, where Murray Gardiner of Temenos presents to the more than 900 participants the ACCU Payment Platform.

July 2015

The BSP launches the country’s National Financial Inclusion Strategy, which includes cooperatives as well as mobile payments as the best means to reach the “underserved” Filipinos in the countryside. One of the signatories to the Strategy was the Chairperson of the Cooperative Development Authority, the Philippine government agency regulating co-ops.

March 2016

NATCCO and PFCCO-Visayas sign an agreement in Myanmar, together with the Association of Asian Confederation of Credit Unions (AACCU), in partnership with software giants, Temenos and Software Group (SG), to pilot the ACCU Payment Platform in the Philippines.

September 2016

The Philippines’ version of the ACCU Payment Platform was re-branded as “KAYA”, signifying the cooperatives ability and capability to grow, reach and expand for its membership. “KAYA” stands for “Kooperatibang may Asenso, Yaman at Abilidad” in Tagalog, and “Kooperatiba: AtongYawisapag-Asenso” in Bisayan.

October 2016

At the 13th National Cooperative Summit held at the SMX Convention Center in Pasay City — attended by more than 4,500 co-op leaders from all over the Philippines – NATCCO and PFCCO presented the framework, advantages, and convenience offered by the KAYA Payment Platform.

At the conclusion of the event, the “Agreements-Resolutions” is declared. Number one in the list is “For co-operatives to adopt, enroll or participate in the KAYA Payment Platform (KPP).”

July 2017

KAYA went live with its first digital channels: the web teller for over-the-counter services and the mobile app. These enabled the opening and maintenance of online KAYA savings accounts for coop members,fund transfers between accounts from different branches of either the same or different coops, and mobile reload and bill payments through its partner aggregator ECPay.

2017

The BSP approves the adoption of the National Retail Payment System Framework (NRPS) to establish a safe, efficient and reliable retail payment system in the Philippines.

September 2018

NATCCO’sPinoyCoop ATM was re-branded, with its ATM network now integrated into the KAYA Platform. Migration towards EMV compliance of the KAYA ATM network was completed under the Bancnet ATM Consortium.

October 2018

The National Retail Payment System Act, which provides for the regulation and supervision of payment systems by the BSP, becomes a law.

November 2018

The World Council of Credit Unions (WOCCU) partners with the Bill & Melinda Gates Foundation and ACCUto design and test an interoperable, open-loop, low-cost, real-time payment platforms for its network of credit unions across Asia.Pilot areas are the Philippines and Indonesia.

We are KAYA

The KAYA Payment Platform is an initiative to modernize and digitally empower the Philippine cooperative movement by providing them and their members a secure and accessible platform for their financial transactions.

With an online KAYA account, co-op members can conveniently:

- Pay their bills

- Send and receive money

- Top up their mobile phones

- Have an ATM/debit card

- And plenty more

KAYA offers you its full support in helping you have a safe and easy digital banking experience with your co-op. To open your account, contact your local KAYA branch and inquire. If you are not yet a co-op member, check out our Branch Locator now to find a KAYA co-op near you.

Our stories

KAYA Payment Platform registered with BSP

Another milestone in the inclusion of co-ops in the digital economy . . .

The BangkoSentral ng Pilipinas (BSP) has informed theNational Confederation of Cooperatives (NATCCO) that it has been “issued a Certificate of Registration (COR) as Operator of Payment System (OPS) effective 29 June 2020.”

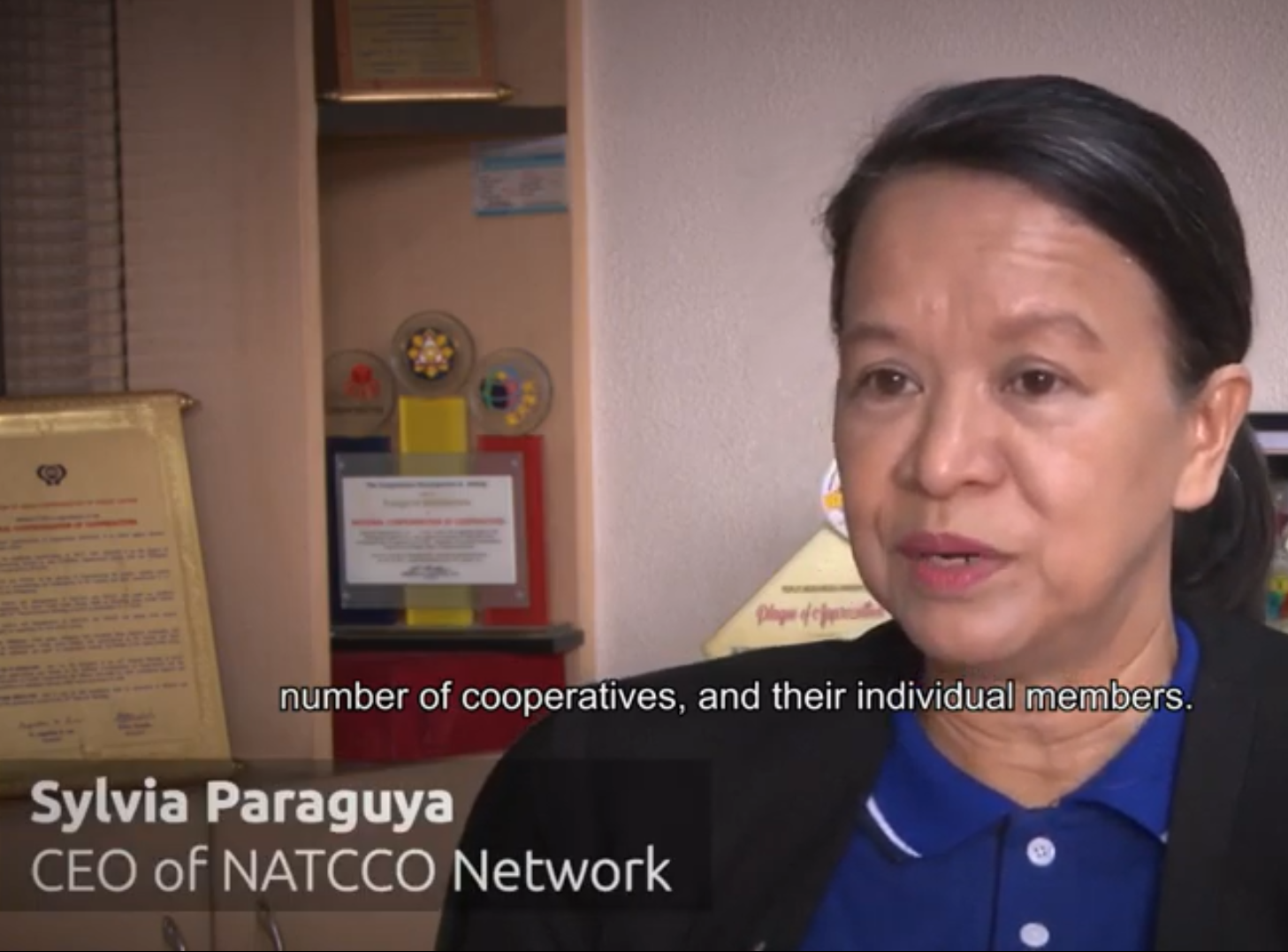

The NATCCO operates the KAYA Payment Platform, its product offering, together with the Philippine Federation of Credit Cooperatives (PFCCO), to co-ops that enables members to transact on four channels – throughinter-operable branches, mobile phones, automated teller machines (ATMs), and EFT-POS terminals.

Pushing for financial inclusion, or ensuring that every Filipino will have better access to formal financial services, the BSP has been keen on getting co-ops on board the National Retail Payment System (NRPS).

BSP Circular 1049 defines OPS as a “person that performs any of the following functions: 1) Maintains the platform that enables payments or fund transfers, regardless of whether the source and destination accounts are maintained with the same or different institutions; 2) Operates the system or network that enables payments or fund transfers to be made through the use of a payment instrument; 3) Provides a system that processes payments on behalf of any person or the government . . .”

Republic Act No. 11127 or the National Payment Systems Act (NPSA) endowed the BSP with the power to oversee the payment systems in the Philippines and exercise supervisory and regulatory powers over these payment systems for the purpose of ensuring the stability and effectiveness of the monetary and financial system.

The NPSA provides a comprehensive legal and regulatory framework which supports the twin objectives of maintaining a payment system that is necessary to control systemic risk and providing an environment conducive to the sustainable growth of the economy.

According to the BSP website, “a payment system provides the channels through which funds are transferred among banks and other institutions to discharge payment obligations arising from economic and financial transactions across the entire economy. An efficient, secure and reliable payment system reduces the cost of exchanging goods and services. It is an essential tool for the effective implementation of monetary policy, and the smooth functioning of money and capital markets.”

Pushing for financial inclusion, or ensuring that every Filipino will have better access to formal financial services, the BSP has been keen on getting co-ops on board the National Retail Payment System (NRPS).

Under BSP Circular No. 1049, OPS that are operating at the time of the effectivity of R.A. No. 11127 are required to register with the BSP. The guidelines on the registration and notification requirements of OPS are provided under Memorandum No. 2019-023.

The registration deadline has been extended a number of times to iron out technical details in the implementation of regulations.

CDA endorses NATCCO, PFCCO for membership in Phil Payments Management Inc.

The Board of Directors of the Cooperative Development Authority (CDA) endorsed the National Confederation of Cooperatives (NATCCO) and the Philippine Federation of Credit Cooperatives to become members of the Philippine Payments Management Inc. (PPMI).

The ‘unanimous’ decision was made in the CDA Board meeting of July 29.

PPMI is a self-governing regulatory structure, ran by payment industry participants in the Philippines, and is duly recognized by the Bangko Sentral ng Pilipinas (BSP) as the country’s Payment System Management Body (PSMB). PPMI formulates, issues, and enforces the National Retail Payment System (NRPS) governance framework, in close coordination with the BSP. Its membership includes all qualified direct clearing participants (banks and non¬bank e-money issuers) in the Philippines.

In the subsequent letter to BSP Governor Benjamin Diokno signed by CDA Chairperson Orlando S. Ravanera, he said: “We look forward to your support for our endorsement and for the direct participation of cooperatives as a step towards mainstreaming institutions that serve the “underserved.”

“We will continue to collaborate with the BSP to achieve this end, including participation in discussions to enhance the framework of the National Retail Payment System framework,” he added.

“We look forward to your support for our endorsement and for the direct participation of cooperatives as a step towards mainstreaming institutions that serve the “underserved.”

Since 2015, the BSP has pushed for Financial Inclusion, wherein every Filipino will have access to formal financial services by 2020. Co-opshave been recognizedas engines to accelerate financial inclusion in the rural areas that are beyond the reach of commercial banks, but where many co-ops operate.

And to boost Financial Inclusion, the BSP also advocates digital transactions that will allow co-op members to perform “cashless transactions” using their mobile phones, through ATMs, and point-of-sale (POS).

NATCCO and PFCCO have partnered since 2016 to provide KAYA Payment Platform exclusively for co-ops, enabling their members to perform such cashless transactions.

In the letter, Ravanera said the CDA recognizes the “initiatives within the cooperativesector (KAYA Payment Platform) that improves the capabilities of cooperatives to provide better and relevant servicesto the millions of mostly low-income individual members.”

Ravanera noted that the joint initiative of the NATCCO and PFCCO to provide a shared payment platform brings digital financial services closer to thousands of small and medium cooperatives, which otherwise, do not have the technical nor financial capacity for such a big undertaking.

The CDA has accompanied NATCCO and PFCCO since 2016 in the dialogues with the BSP’s team, eventually the PaymentSystems Oversight Department, on the National Retail Payment Systems framework.